You have no items in your shopping cart.

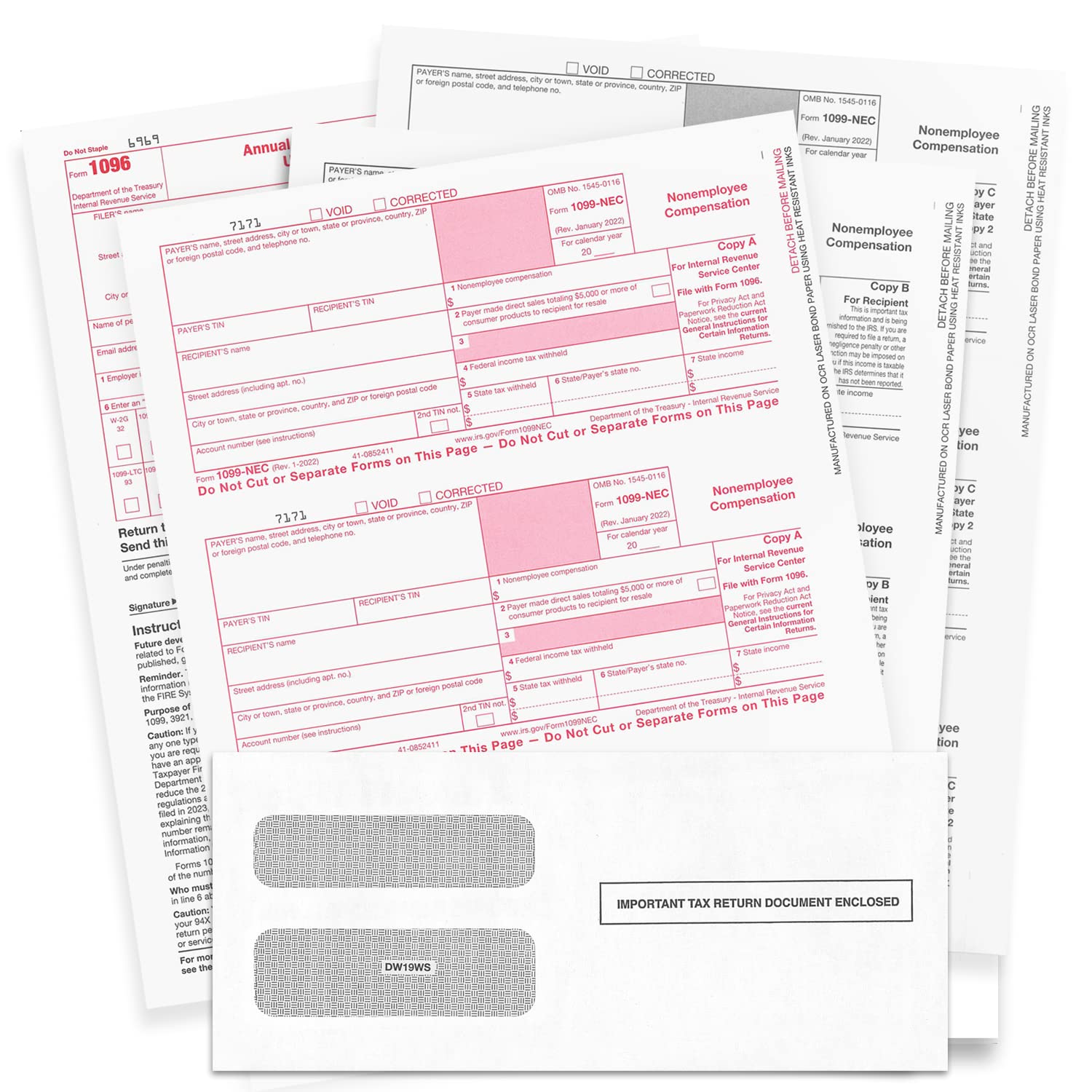

> New Form 1099-NEC The IRS has revived this old form for reporting non-employee compensation for the 2024 tax year. If you typically file Form 1099-MISC (with Box 7 completed), you will need to file Form 1099-NEC. Data currently reported in Box 7 (Nonemployee compensation) of Form 1099-MISC for tax year will be required to be reported in Box 1 of Form 1099-NEC for tax year 2024. The Internal Revenue Service (IRS) and various states are requiring this form to be filed by the effective deadline, February 1

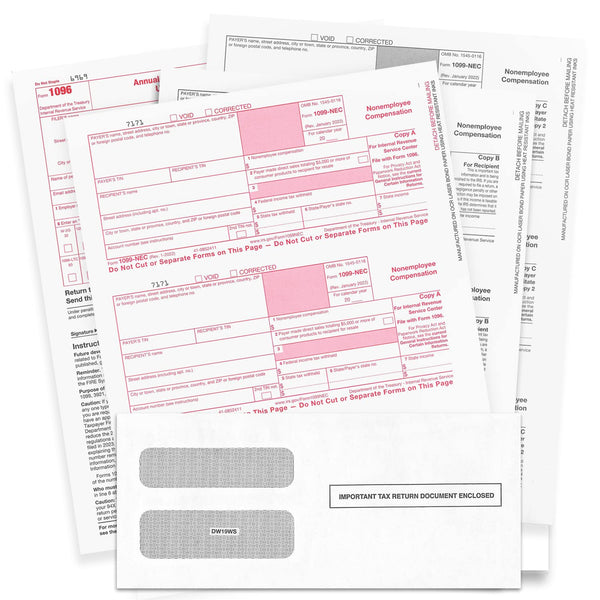

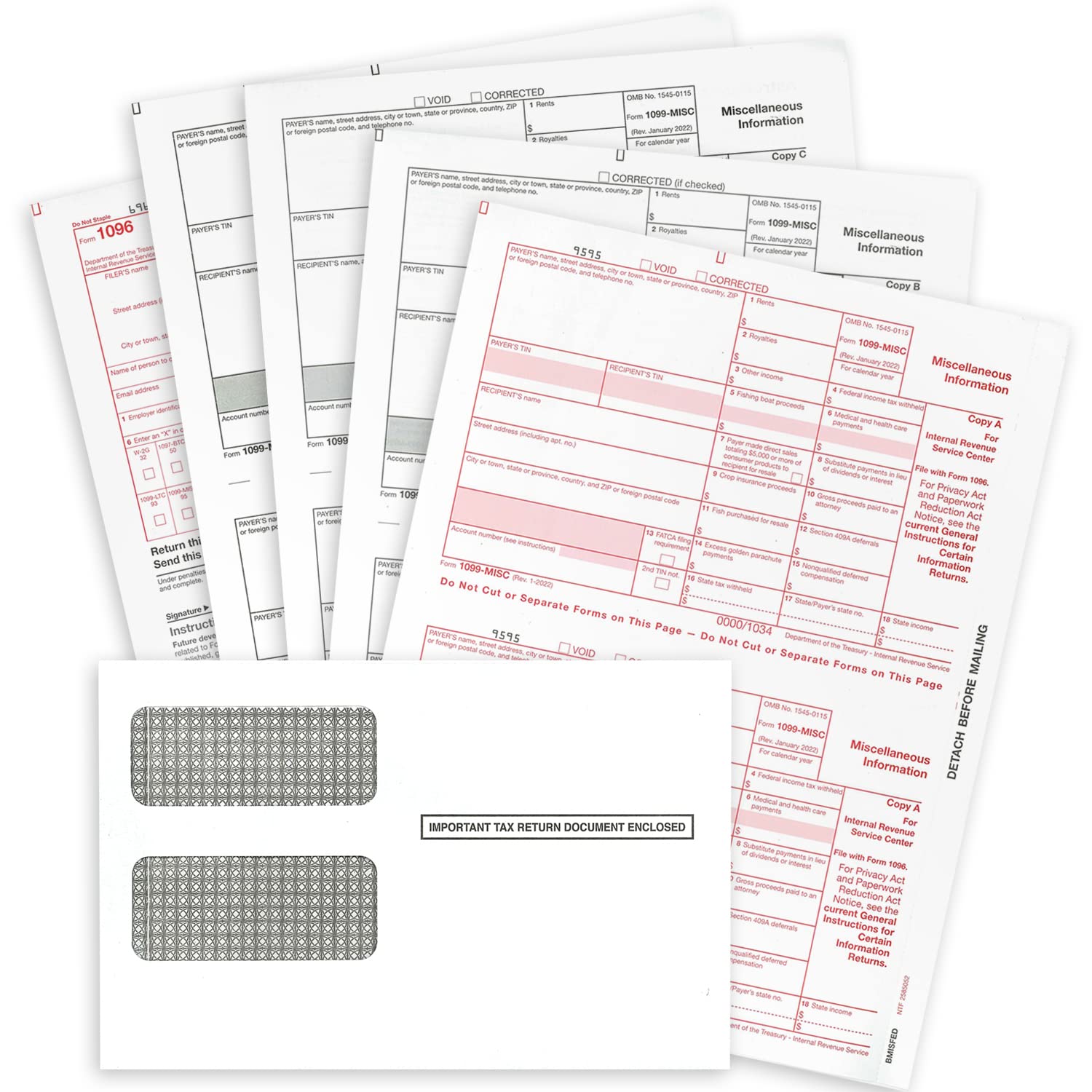

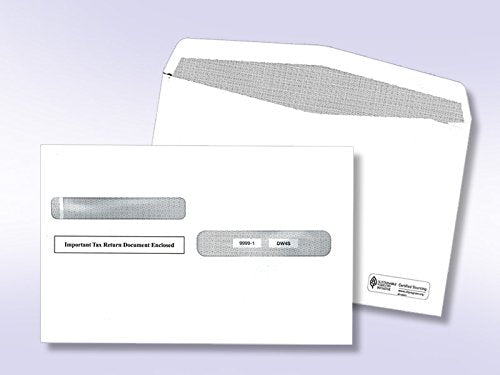

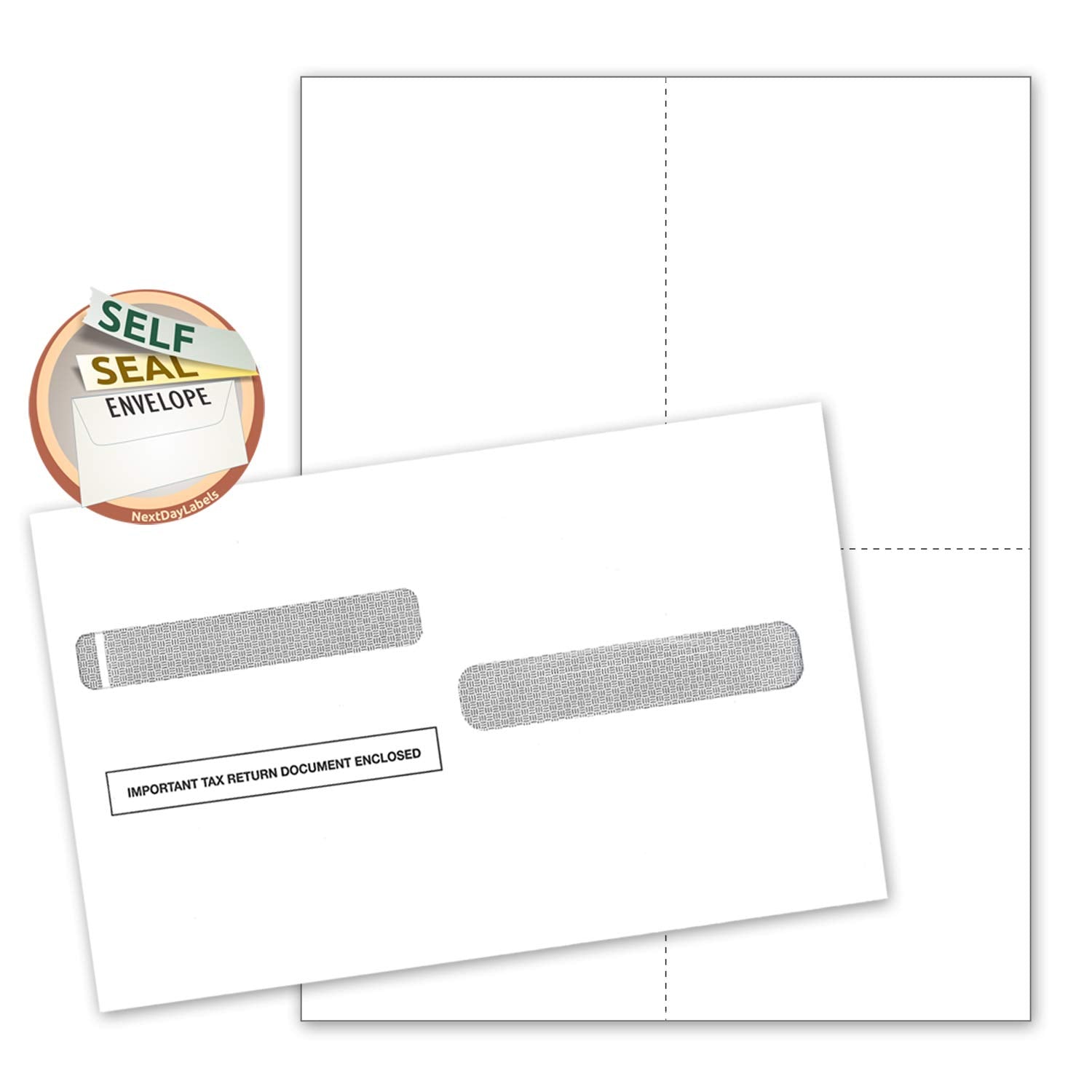

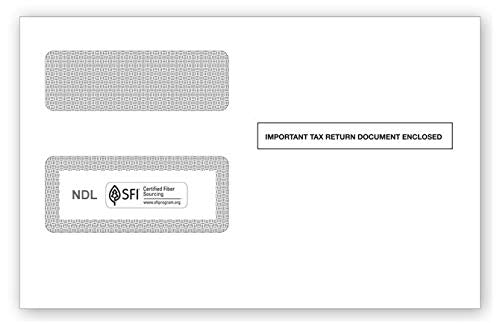

- ✔️ Filing your 1099 NEC forms is easy with our 2024 bundle of 25 1099 NEC Forms and 25 self-seal envelopes. Everything you need is in this kit. Simply print and mail.

- ✔️ Compatible with QuickBooks and other tax software, the forms feature precise spaces where each field should be filled in. These spaces will line up perfectly with your printed words.

- ✔️ Quality makes a difference. Our thick 20 lb. paper is made in the U.S. and will feed smoothly through your laser or inkjet printer. No jamming, no hassle.

- ✔️ IRS-Approved, this bundle of 1099 NEC forms for 2024 includes all the documents you need.

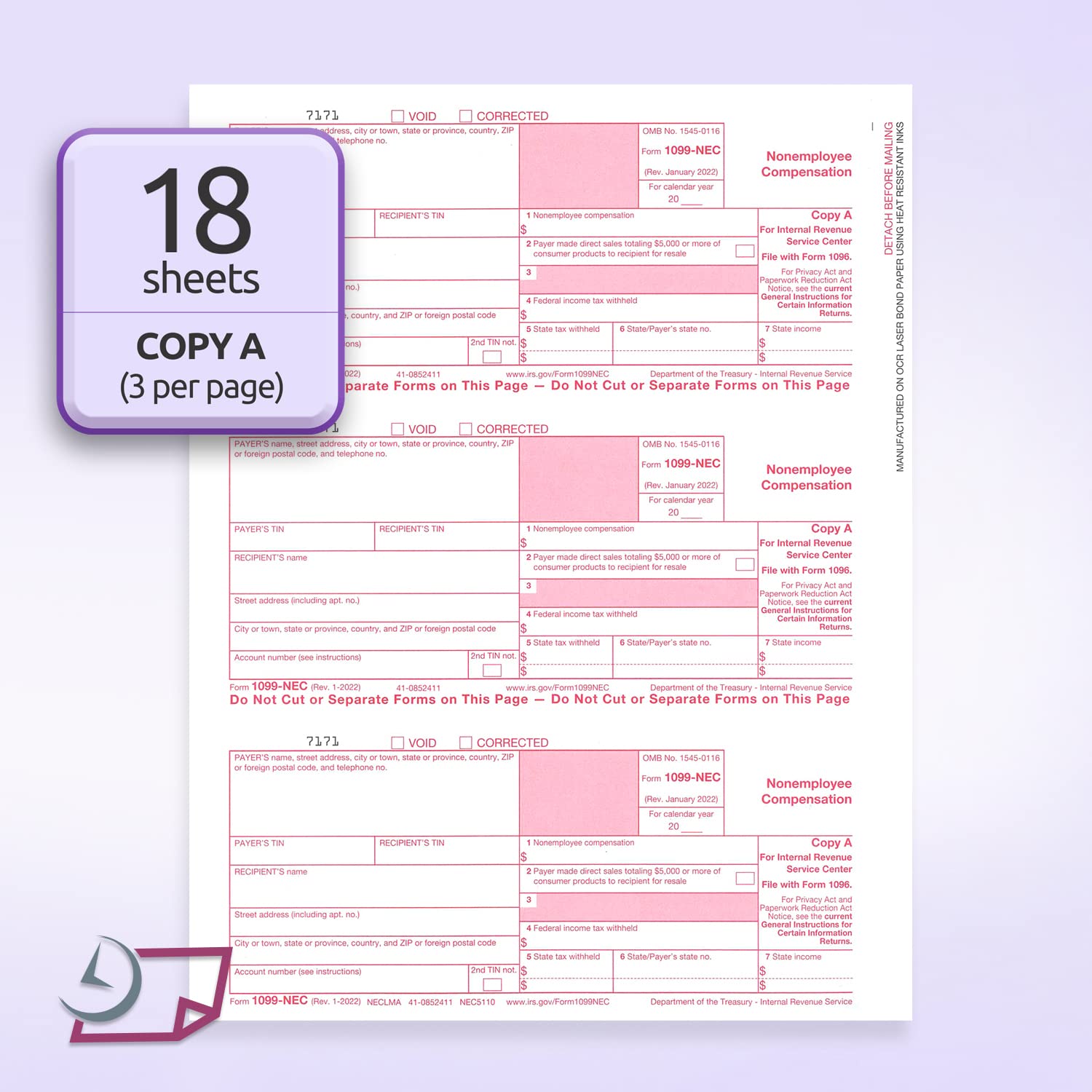

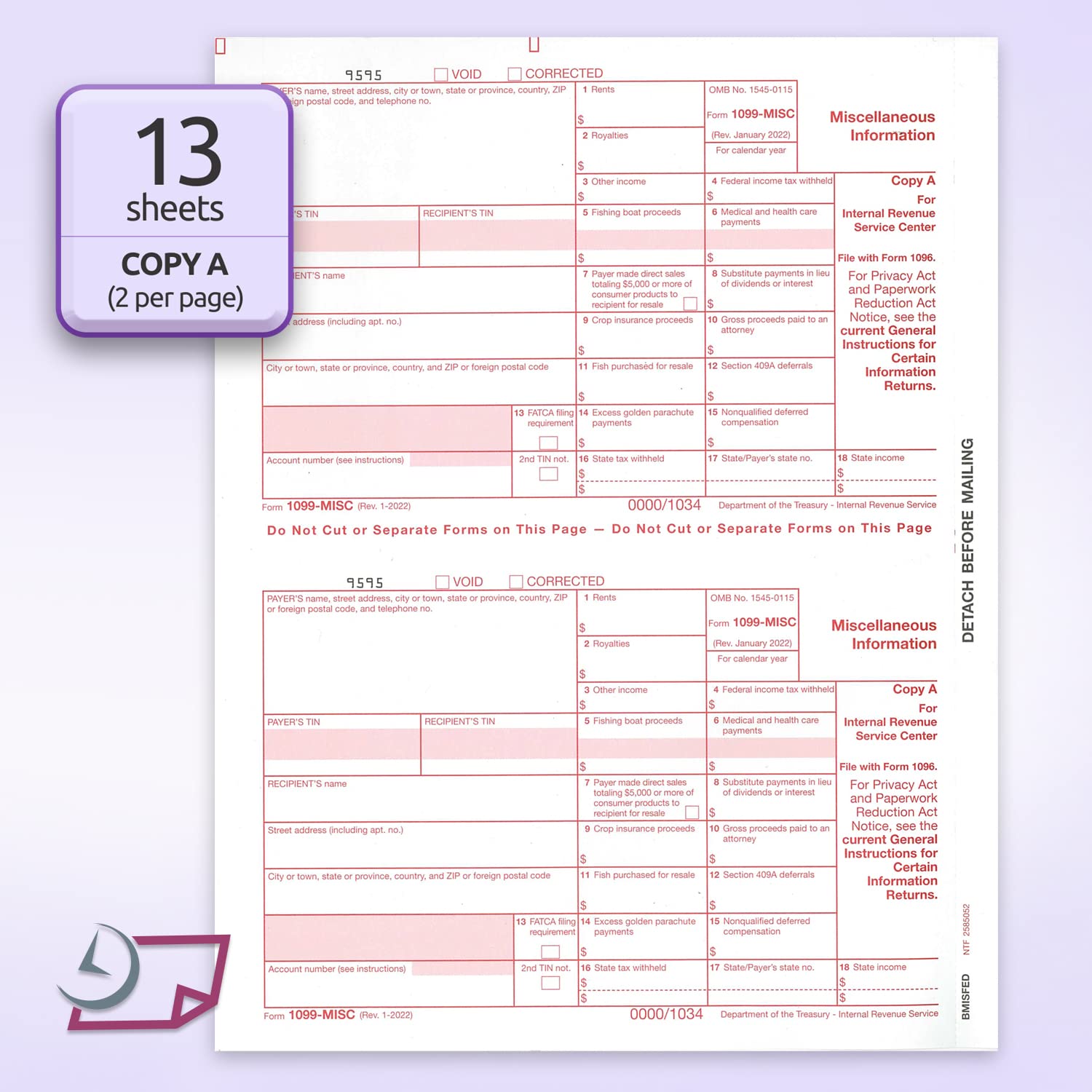

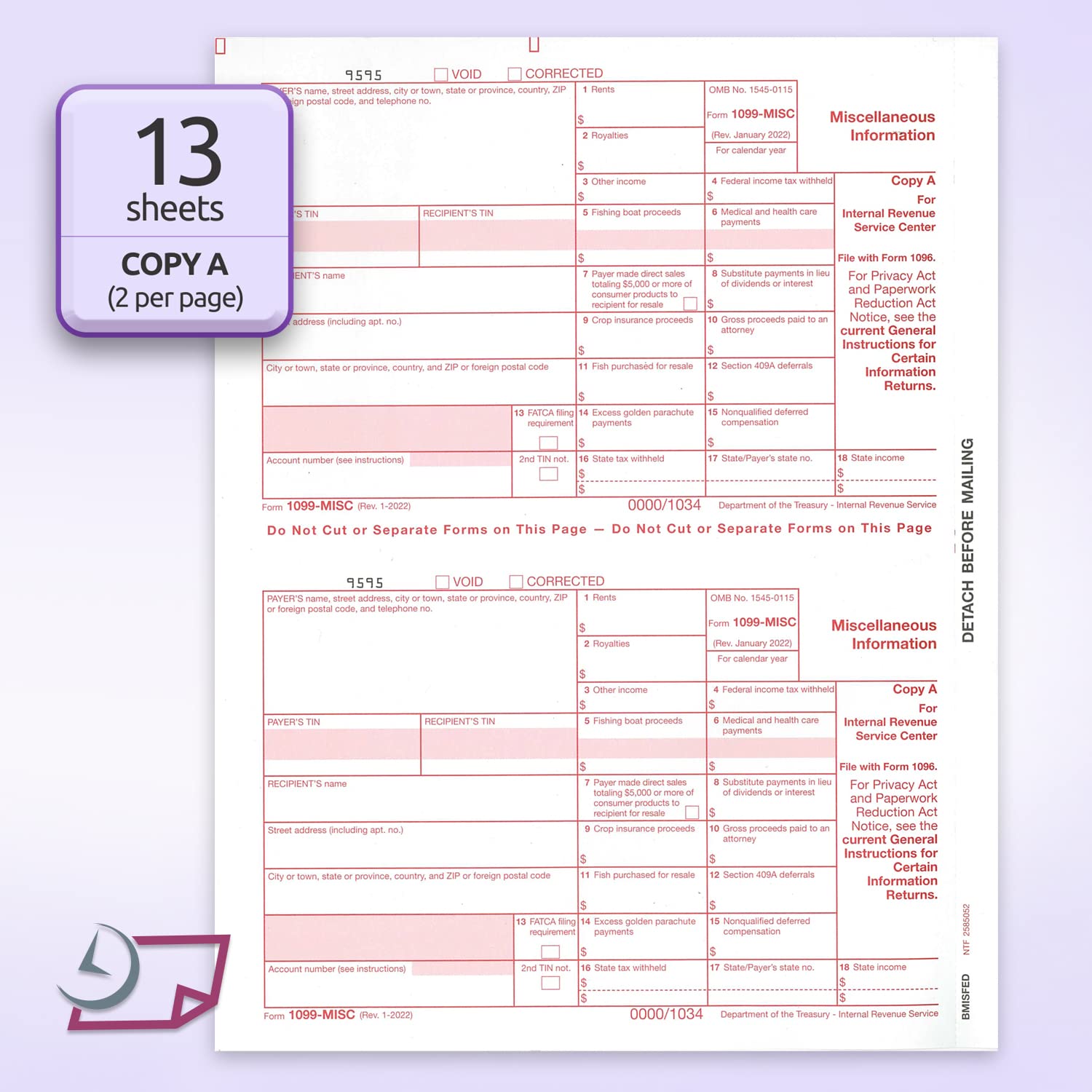

- ✔️ In this all-inclusive packet for 25 vendors, contractors, or suppliers, here’s what you get: 9 sheets of COPY A, 9 sheets of COPY B, 18 sheets of C/1, 25 self seal envelopes, and 3 1096 Transmittal forms.

Free & Fast Shipping

Free & Fast Shipping